4

📌 Company: Admach Systems Limited

🏭 Business: Designs and manufactures custom industrial machinery, automation systems, special-purpose machines, assembly and packaging equipment, and robotic material-handling systems for Indian and global engineering sectors. The Tribune

📈 Listing Platform: BSE SME (Small & Medium Enterprises platform) The Tribune

📊 Issue Type: Book-building Fresh Issue (no offer for sale component) Zerodha

📅 IPO Timeline (Tentative)

- IPO Opens: 23 Dec 2025 Zerodha

- IPO Closes: 26 Dec 2025 Zerodha

- Basis of Allotment: 29 Dec 2025 Zerodha

- Refunds: 30 Dec 2025 Zerodha

- Shares Credited to Demat: 30 Dec 2025 Zerodha

- Listing Date: 31 Dec 2025 Zerodha

💰 Price & Lot Details

- Price Band: ₹227 – ₹239 per share Zerodha

- Face Value: ₹10 per share The Tribune

- Lot Size: 600 shares Zerodha

- Minimum Investment (Retail): ~₹2,86,800 (600 × ₹239 × 2 lots = typical retail application) Kotak Securities

(Retail bidders generally apply in multiples of the lot size.) - Total Issue Size: ~₹42.6 crore (17,82,600 shares) Zerodha

📊 Allocation & Share Breakdown

- The IPO is entirely a fresh issue with shares allocated among various investor categories, including retail, non-institutional investors, qualified institutional buyers, anchor investors and market makers. The Tribune

🏢 Company Business Summary

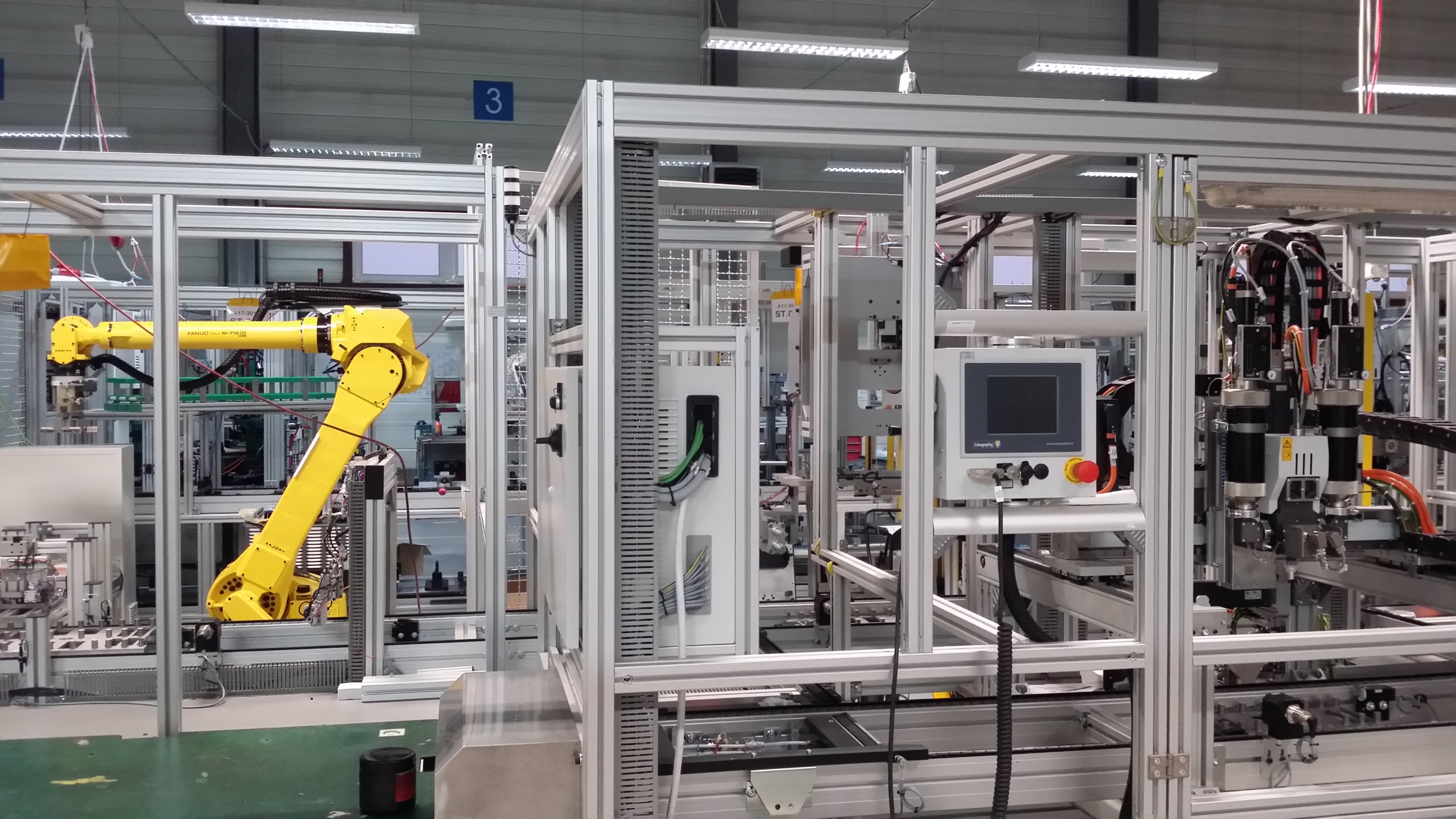

Admach Systems is a Pune-based engineering solutions provider specialising in customised machinery for industries such as steel, automobile, food processing, tooling and other engineering sectors. The product offering includes:

- Special purpose machines (SPMs)

- Automation and assembly systems

- Packaging machines

- Robotic material handling systems

- After-sales support and technical services for supplied equipment The Tribune

🎯 Use of IPO Proceeds

Funds raised in the IPO are intended to be used for:

- Purchasing and installing new machinery

- Meeting working capital needs

- General corporate purposes Goodreturns

📈 Financial Snapshot

According to preliminary reporting, the company has shown increasing revenues and profits over recent years:

- FY25 Revenue: ~₹53.5 crore

- FY25 Profit After Tax: ~₹6.1 crore

(With earlier years showing growth trends.) IPO Premium

🧑💼 Promoters & Management

Promoter leadership includes Ajay Chamanlal Longani (Managing Director) along with family members and an experienced executive team driving engineering design and business strategy. The Tribune

📊 Investment Notes

- SME IPOs are typically higher-risk, higher-volatility investments with lower liquidity compared to mainboard listings.

- Check your broker app or registrar (Maashitla Securities) for subscription status and allotment results after the offer closes.