🏢 Company Overview

Neptune Logitek Limited is an Indian logistics and supply-chain services company. It provides freight forwarding, transportation, customs clearance, and end-to-end logistics solutions using road, rail, and air networks. The company focuses on efficient cargo movement supported by technology-enabled operations.

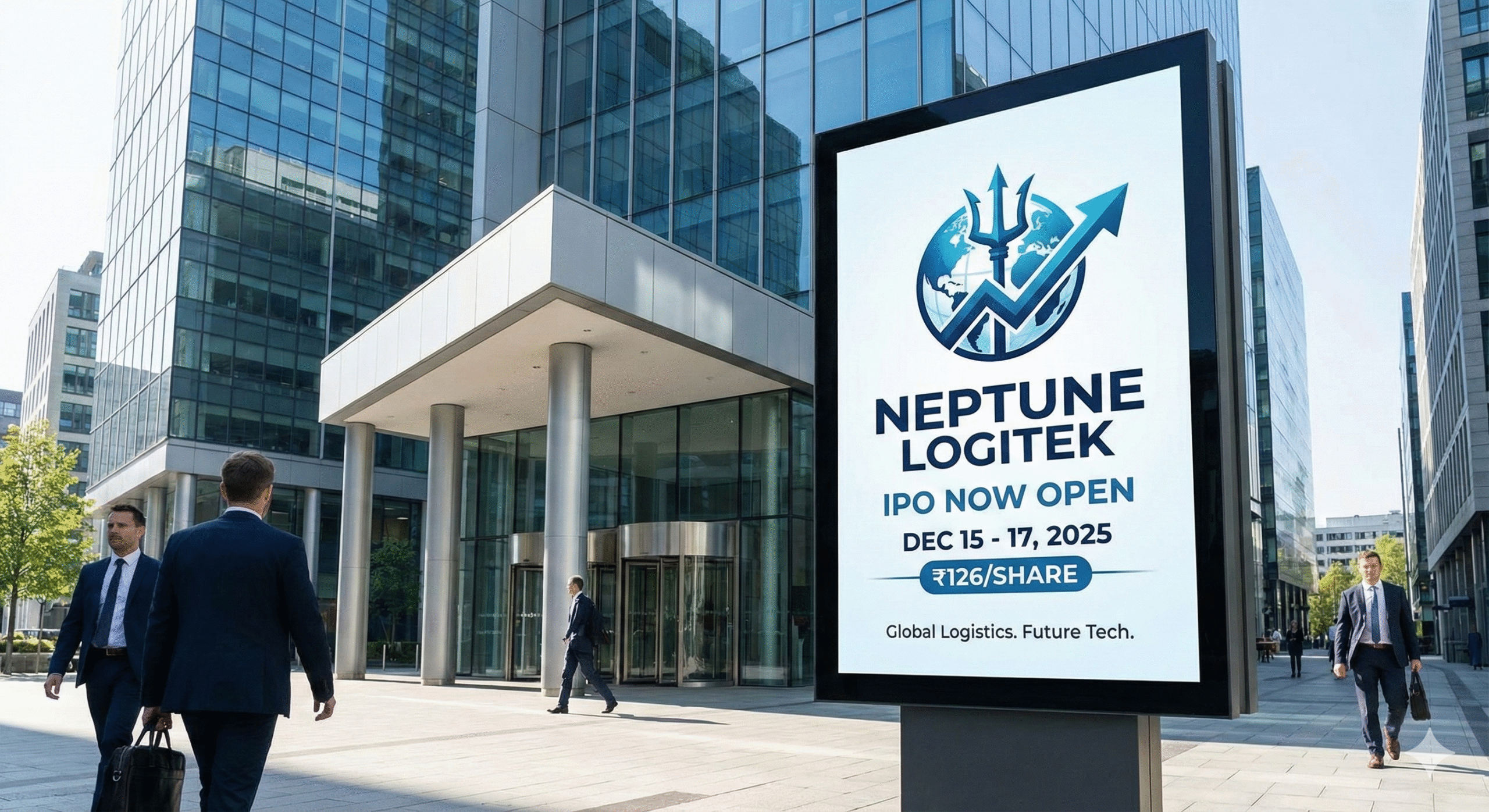

📅 IPO Timeline

- IPO Opening Date: 15 December 2025

- IPO Closing Date: 17 December 2025

- Allotment Finalisation: 18 December 2025

- Refund Initiation: 19 December 2025

- Demat Credit: 19 December 2025

- Listing Date: 22 December 2025

💰 Issue Details

- Issue Type: SME IPO (Fixed Price)

- Exchange: BSE SME

- Issue Size: ₹46.62 crore

- Price: ₹126 per equity share

- Face Value: ₹10 per share

- Lot Size: 1,000 shares

- Minimum Investment: ₹1,26,000 per lot

- Issue Structure: 100% fresh issue (no offer for sale)

🎯 Use of IPO Proceeds

The funds raised through the IPO will be used for:

- Expansion of logistics infrastructure and fleet

- Repayment or reduction of existing borrowings

- Working capital requirements

- General corporate purposes

📊 Market Sentiment

- Grey Market Premium (GMP) around the issue period indicated neutral to cautious sentiment

- The IPO is positioned mainly for long-term investors interested in logistics and SME growth stories rather than short-term listing gains

📌 Key Takeaway

Neptune Logitek’s IPO provides exposure to India’s growing logistics sector through the SME platform. Investors should evaluate business scalability, margins, and SME liquidity before investing.