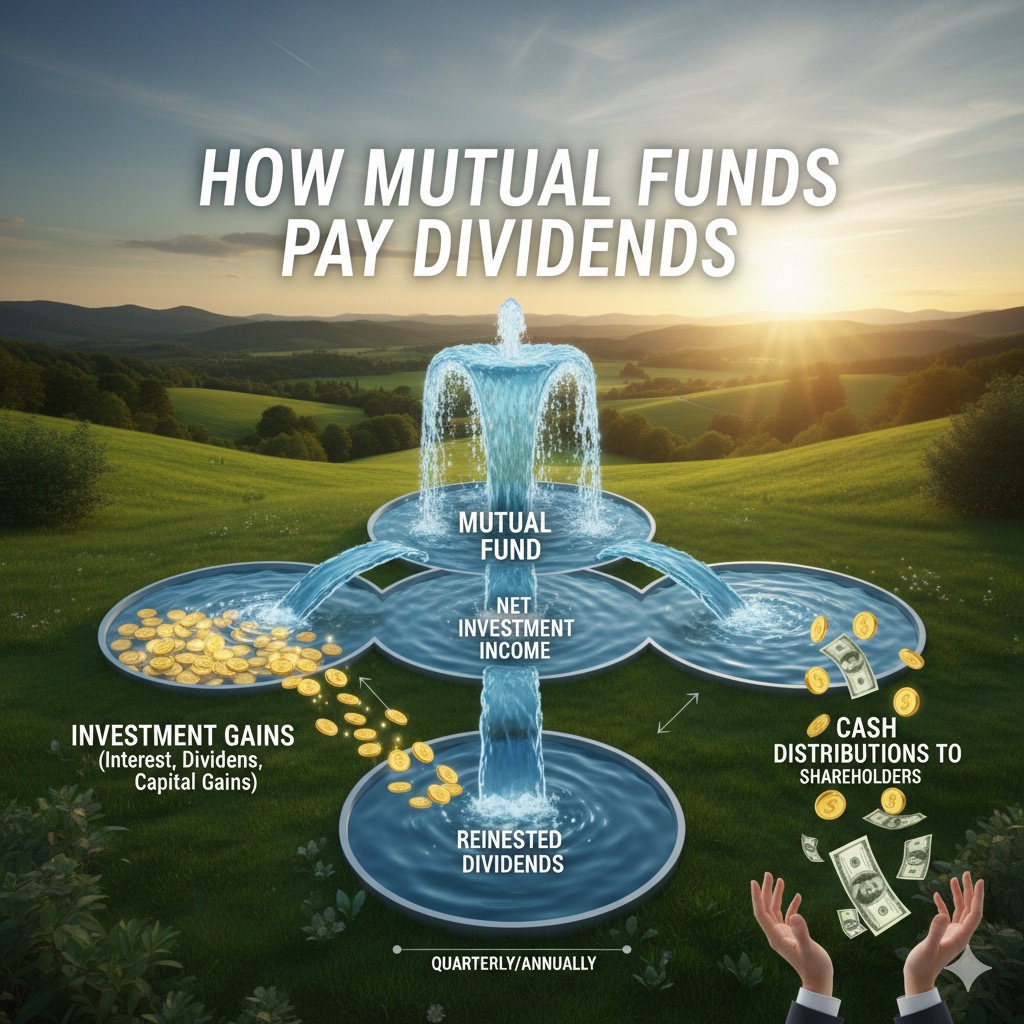

Mutual funds hold a portfolio of assets such as stocks, bonds, and money market instruments. These assets generate income. The fund collects that income and then distributes it to investors.

✅ 1. Fund earns income

Mutual funds receive:

- Dividends from stocks 🏢💰

- Interest from bonds 💵📈

- Capital gains when they sell securities at a profit 🔄📊

✅2. Dividend pool is created

All this income is added together and becomes a dividend pool for the fund.

✅ 3. NAV is adjusted

Before paying dividends, the fund’s Net Asset Value (NAV) goes down by the dividend amount.

Example:

- NAV before dividend = ₹20

- Dividend declared = ₹1 per unit

- NAV after dividend = ₹19

This is normal — part of your investment is returned as cash.

✅ 4. Dividend is paid to investors

If you hold units of the fund on the record date, you receive the dividend.

Payment options depend on your chosen plan:

📌

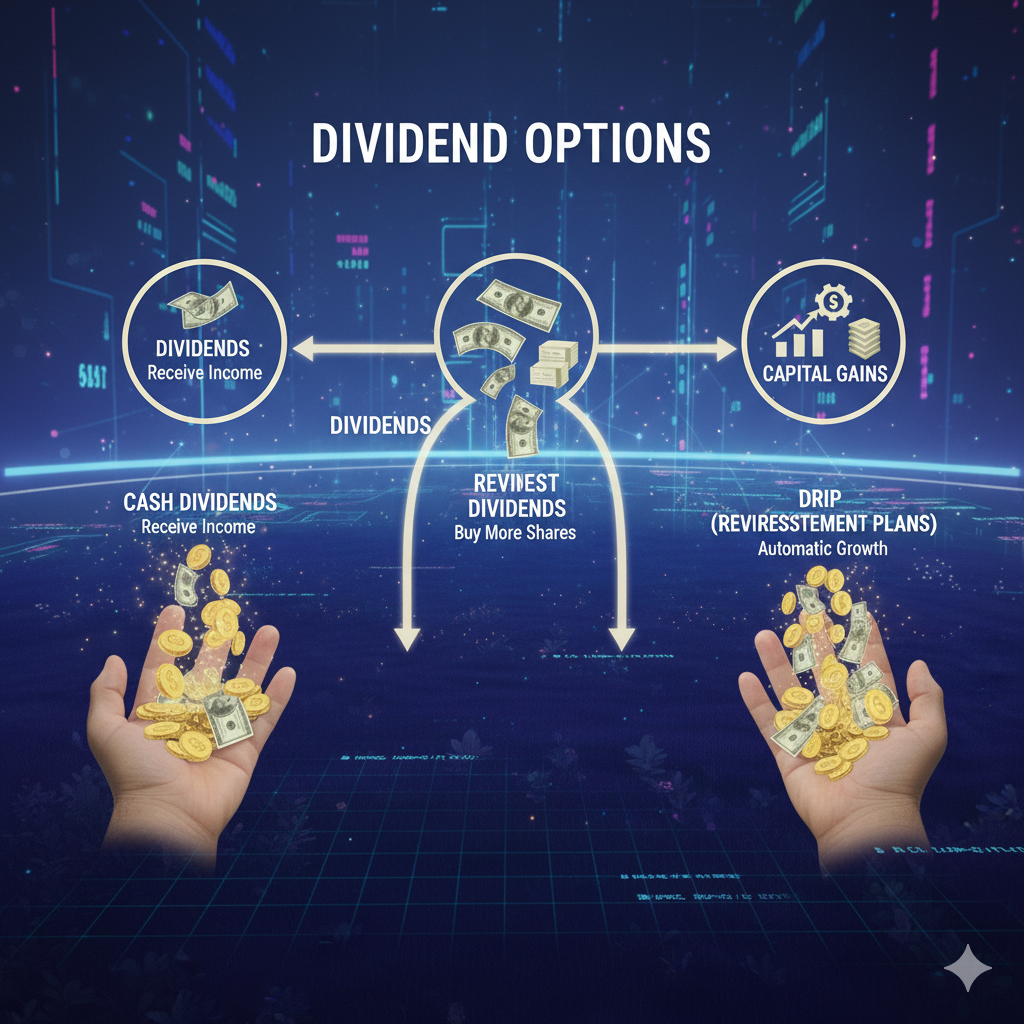

Dividend Options

a) Dividend Payout

- You receive the dividend as cash directly to your bank account 🏦💵.

b) Dividend Reinvestment

- Dividend amount is used to buy more units of the same fund 🔄📈.

c) IDCW Option

Now called Income Distribution cum Capital Withdrawal — same functioning as dividend but with new SEBI terminology.

📝

Important Points

- Dividends don’t mean extra profit — they are paid from the fund’s own corpus.

- NAV always drops after dividends.

- Growth funds do not pay dividends — all profits stay invested to increase NAV.

📦

Simple Example

You hold 1,000 units of a mutual fund.

Fund declares:

- Dividend = ₹1 per unit

You receive:

- ₹1,000 credited to your bank account (if payout option).

- Or extra units worth ₹1,000 (if reinvestment).