4

📌 IPO Snapshot

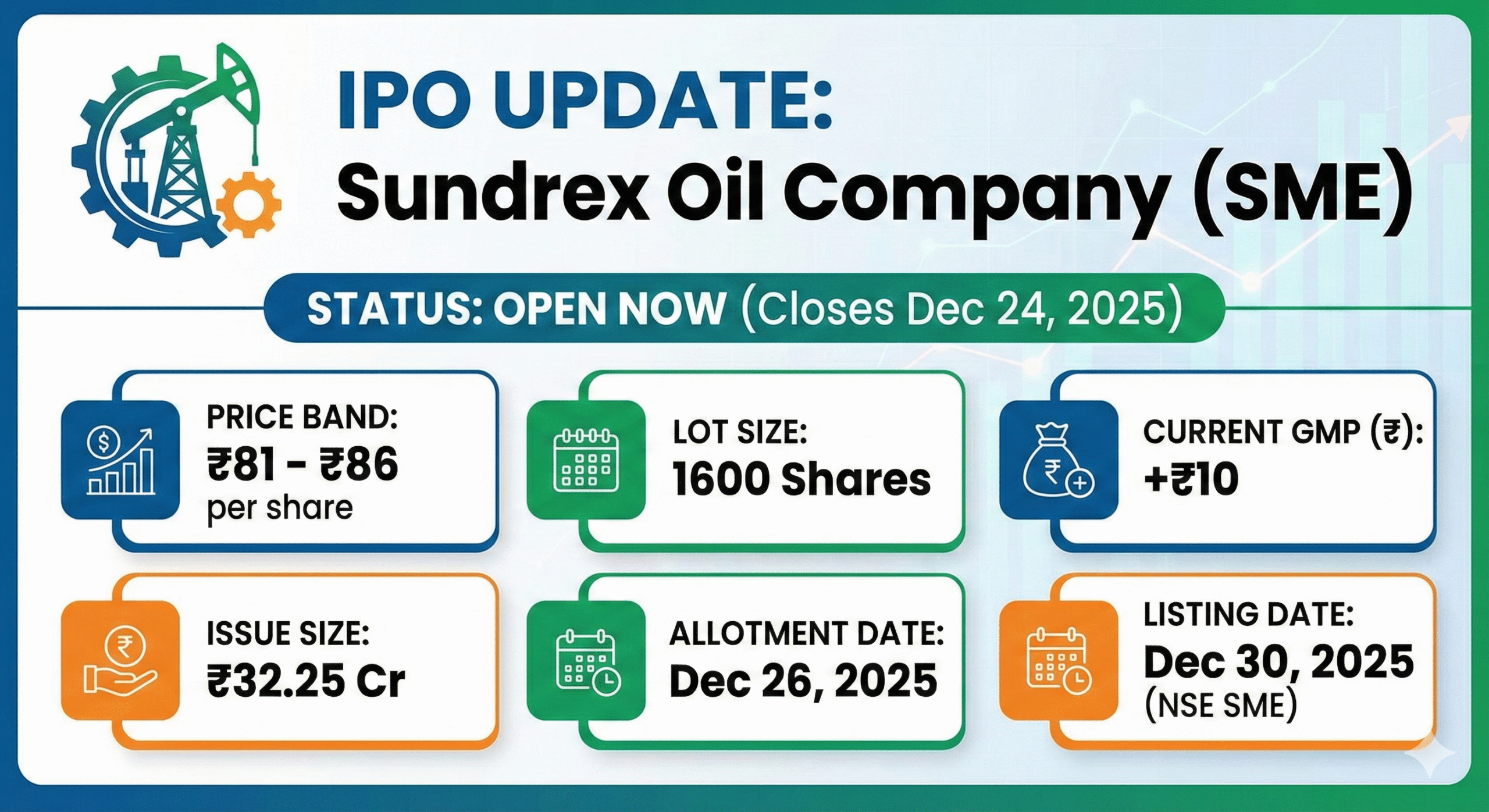

- Company Name: Sundrex Oil Company Limited

- IPO Type: SME Book Built Issue

- Exchange: NSE SME (Emerge Platform)

- Issue Size: Approx. ₹32.25 crore

- Issue Structure: 100% Fresh Issue

- Face Value: ₹10 per share

💰 Price & Lot Details

- Price Band: ₹81 – ₹86 per share

- Lot Size: 1,600 shares

- Minimum Investment: Approx. ₹1.37 lakh (at upper price band)

📅 Important Dates (Tentative)

- IPO Opening Date: 22 December 2025

- IPO Closing Date: 24 December 2025

- Allotment Date: 26 December 2025

- Refunds Initiation: 29 December 2025

- Shares Credited to Demat: 29 December 2025

- Listing Date: 30 December 2025

🏭 About the Company

Sundrex Oil Company Limited is engaged in the manufacturing and distribution of industrial lubricants, automotive oils, greases, and specialty oil products. The company also provides contract manufacturing and private-label solutions for various lubricant brands.

🎯 Use of IPO Proceeds

Funds raised through the IPO will be used for:

- Meeting working capital requirements

- Purchase of plant and machinery

- Repayment or reduction of borrowings

- General corporate purposes

- IPO-related expenses

👥 Promoters

- Mahesh Sonthalia

- Shashank Sonthalia

- Aman Sonthalia

📈 Investment Note

This is an SME IPO, suitable mainly for investors with higher risk appetite, as SME stocks usually have lower liquidity and higher volatility compared to mainboard IPOs.