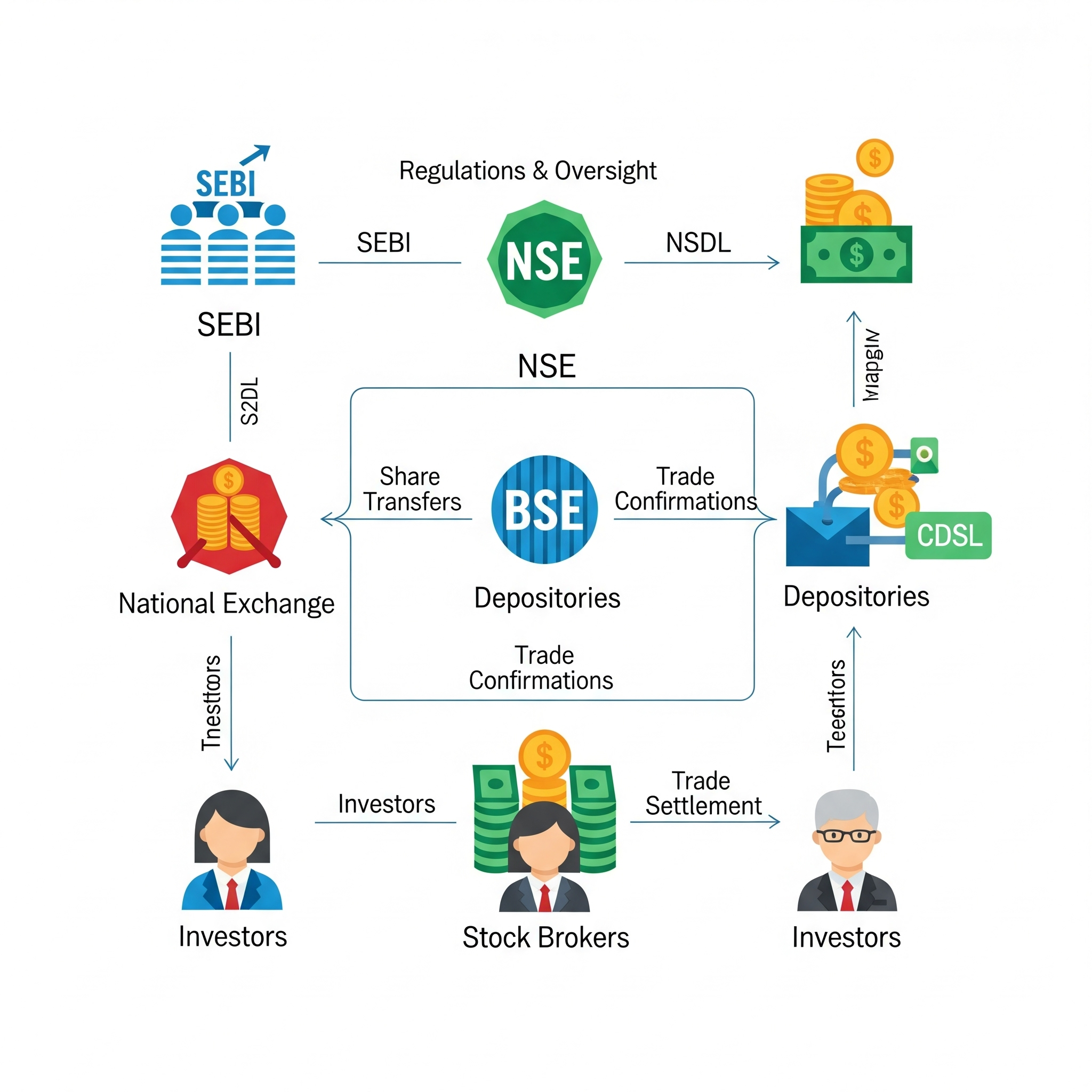

The Indian stock market functions as a well-oiled machine involving several key participants, each with a specific role to ensure trades are safe, transparent, and efficient.

1. The Key Participants

Before understanding the process, you need to know who is involved:

SEBI (Securities and Exchange Board of India)

- Role: The Regulator (The “Watchdog”).

- Function: SEBI sets the rules, protects investors’ interests, and ensures the market operates fairly. All exchanges, brokers, and depositories answer to SEBI.

Stock Exchanges (The Marketplace)

- Key Players:

- NSE (National Stock Exchange): India’s largest exchange by turnover.

- BSE (Bombay Stock Exchange): Asia’s oldest stock exchange.

- Function: They provide the infrastructure (trading computers and software) where buyers and sellers meet electronically.

Depositories (The Vaults)

- Key Players:

- NSDL (National Securities Depository Limited)

- CDSL (Central Depository Services Limited)

- Function: They hold your shares in digital format (Dematerialized or “Demat” form). Think of them as a bank for your shares.

Stock Brokers (The Middlemen)

- Examples: Zerodha, Groww, ICICI Direct, HDFC Securities.

- Function: Individual investors cannot trade directly on the exchange. Brokers act as intermediaries, taking your orders and sending them to the exchange.

Clearing Corporations

- Key Players: NSCCL (NSE Clearing) and ICCL (BSE Clearing).

- Function: They guarantee the settlement of trades. They ensure the buyer gets the shares and the seller gets the money.

2. The Step-by-Step Trading Process

Here is what happens behind the scenes when you buy a share:

Step 1: Placing the Order

- You (The Investor): You open your broker’s app (e.g., Kite, Groww) and place a “Buy” order for 10 shares of Reliance Industries at ₹2,500.

- The Broker: Checks if you have enough funds in your account. If yes, the broker sends your order to the Stock Exchange (NSE or BSE).

Step 2: Order Matching

- The Exchange: The exchange’s computer looks for a “Sell” order that matches yours (someone selling Reliance at ₹2,500).

- Execution: When a match is found, the trade is executed instantly. You receive a confirmation notification on your app.

Step 3: Clearing and Settlement (T+1 Cycle)

India follows the T+1 (Trade + 1 Day) settlement cycle.

- Trade Day (T): The transaction happens. The broker issues a contract note (bill) to you.

- Settlement Day (T+1): By the next working day:

- Money: Funds are deducted from your trading account and sent to the Clearing Corporation, then to the seller’s broker, and finally to the seller.

- Shares: Shares are debited from the seller’s Demat account and credited to your Demat account (held with NSDL or CDSL).

3. Key Market Indices

To track the overall health of the market, we use indices which represent a basket of top companies:

- Nifty 50: Tracks the top 50 companies listed on the NSE.

- Sensex: Tracks the top 30 companies listed on the BSE.

If the Nifty goes up, it generally means the top 50 companies in India are doing well, and market sentiment is positive.