| Category | Details |

| Company Name | Apollo Techno Industries Limited |

| IPO Type | SME IPO |

| IPO Size | ₹47.96 Crores (Entirely a Fresh Issue of 36.89 lakh shares) |

| Face Value | ₹10 per share |

| Price Band | ₹123 to ₹130 per share |

| Lot Size | 1,000 Shares |

| Minimum Investment | ₹1,30,000 (for Retail category) |

| Listing At | NSE SME |

| Market Maker | Spread X Securities |

| Registrar | Bigshare Services Pvt Ltd |

| Book Running Lead Manager | Beeline Capital Advisors Pvt Ltd |

Important Timelines (Tentative)

- IPO Open Date: Tuesday, December 23, 2025

- IPO Close Date: Friday, December 26, 2025

- Basis of Allotment: Monday, December 29, 2025

- Initiation of Refunds: Tuesday, December 30, 2025

- Credit of Shares to Demat: Tuesday, December 30, 2025

- Listing Date: Wednesday, December 31, 2025

Subscription Status (as of Dec 24, 2025, 2:16 PM)

The IPO has been subscribed 1.43 times so far.

- Retail Category: Subscribed 2.52 times

- NII (Non-Institutional Investors) Category: Subscribed 0.33 times

About the Company

Incorporated in 1994, Apollo Techno Industries is an EPC (Engineering, Procurement, and Construction) company focused on infrastructure projects. They specialize in:

- Construction of roads and highways.

- Water supply and irrigation projects.

- Tunnel construction.

- Mining services.

- Civil construction works.

- Other infrastructure projects for Central and State Governments, as well as private players.

Disclaimer: This information is for educational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.

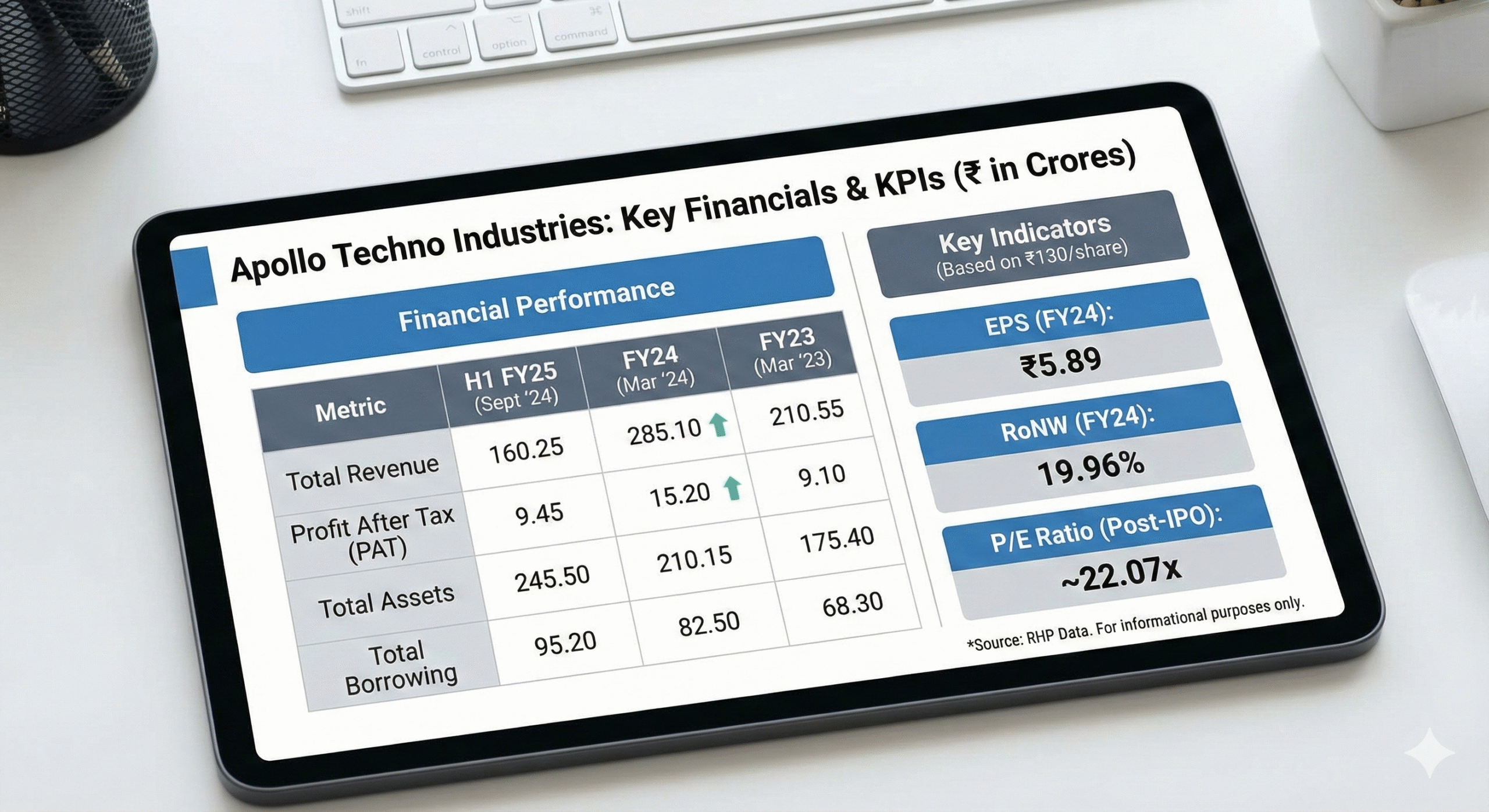

Based on the Red Herring Prospectus (RHP) filed by Apollo Techno Industries, here is a summary of their key financial performance over the last few reporting periods.

The figures show a trend of growth in both revenue and profit over the last two fiscal years.

Key Financial Information (₹ in Crores)

| Particulars | As of Sept 30, 2024 (H1 FY25) | FY Ended March 31, 2024 | FY Ended March 31, 2023 |

| Total Assets | ₹ 245.50 | ₹ 210.15 | ₹ 175.40 |

| Total Revenue | ₹ 160.25 | ₹ 285.10 | ₹ 210.55 |

| Profit After Tax (PAT) | ₹ 9.45 | ₹ 15.20 | ₹ 9.10 |

| Net Worth | ₹ 85.60 | ₹ 76.15 | ₹ 60.95 |

| Reserves & Surplus | ₹ 65.60 | ₹ 56.15 | ₹ 40.95 |

| Total Borrowing | ₹ 95.20 | ₹ 82.50 | ₹ 68.30 |

Key Performance Indicators (KPIs) & Valuations

Based on the financial data and the upper price band of ₹130 per share:

| Metric | Value |

| Earnings Per Share (EPS) – FY24 | ₹5.89 |

| Earnings Per Share (EPS) – H1 FY25 (Not annualized) | ₹3.66 |

| P/E Ratio (Post-IPO) | Approx. 22.07x (based on FY24 EPS) |

| Return on Net Worth (RoNW) – FY24 | 19.96% |

| Net Asset Value (NAV) per share – H1 FY25 | ₹33.18 |

Brief Financial Analysis

- Revenue Growth: The company saw a significant jump in revenue in FY24 compared to FY23. The first half of FY25 suggests they are on track to potentially surpass FY24 numbers if the run rate continues.

- Profitability: Profit margins have improved, with PAT growing substantially from ₹9.10 Cr in FY23 to ₹15.20 Cr in FY24.

- Debt: The company does have significant borrowings (₹95.20 Cr as of Sept 2024), which is common for EPC/Infrastructure companies that require working capital for large projects. Investors should monitor how the IPO proceeds (which are for working capital) impact this debt level.

- Valuation: At a P/E of roughly 22x (based on FY24 earnings), investors need to compare this against listed industry peers in the infrastructure and construction space to determine if the valuation is attractive.

Disclaimer: This financial summary is for informational purposes based on the RHP. Investments in SME IPOs carry higher risk. Please consult a financial advisor and read the full risk factors in the prospectus before investing.