Here are the detailed facts about the Bai-Kakaji Polymers SME IPO, currently open for subscription.

| Category | Details |

| Company Name | Bai Kakaji Polymers Limited |

| IPO Type | SME IPO (Book Built Issue) |

| IPO Size | ₹105.17 Crores (Entirely a Fresh Issue of 56.54 lakh shares) |

| Face Value | ₹10 per share |

| Price Band | ₹177 to ₹186 per share |

| Lot Size | 600 Shares |

| Minimum Investment | ₹1,11,600 (for Retail investors, at upper price band) |

| Listing At | BSE SME |

| Market Maker | Hem Finlease Pvt. Ltd. |

| Registrar | Maashitla Securities Pvt. Ltd. |

| Book Running Lead Manager | Hem Securities Ltd. |

Important Timelines (Tentative)

- IPO Open Date: Tuesday, December 23, 20251

- IPO Close Date: Friday, December 26, 20252

- Basis of Allotment: Monday, December 29, 20253

- Initiation of Refunds: Tuesday, December 30, 2025

- Credit of Shares to Demat: Tuesday, December 30, 2025

- Listing Date: Wednesday, December 31, 2025

Subscription Status (Live Update as of Dec 24, 2025)

The IPO has been subscribed approximately 1.37 times so far.

- Qualified Institutional Buyers (QIB): Subscribed ~3.92 times

- Non-Institutional Investors (NII): Subscribed ~0.82 times

- Retail Individual Investors (RII): Subscribed ~0.16 times

About the Company

Incorporated in 2013, Bai Kakaji Polymers is engaged in the manufacturing of polymer-based packaging products. Their key offerings include:

- PET Preforms: Used for bottling various liquids.4

- Plastic Caps & Closures: Including specialized closures like Alaska closures for packaged drinking water and caps for carbonated soft drinks.

The company operates manufacturing units in Latur, Maharashtra, and caters to industries like packaged drinking water, carbonated beverages, juices, and dairy products.

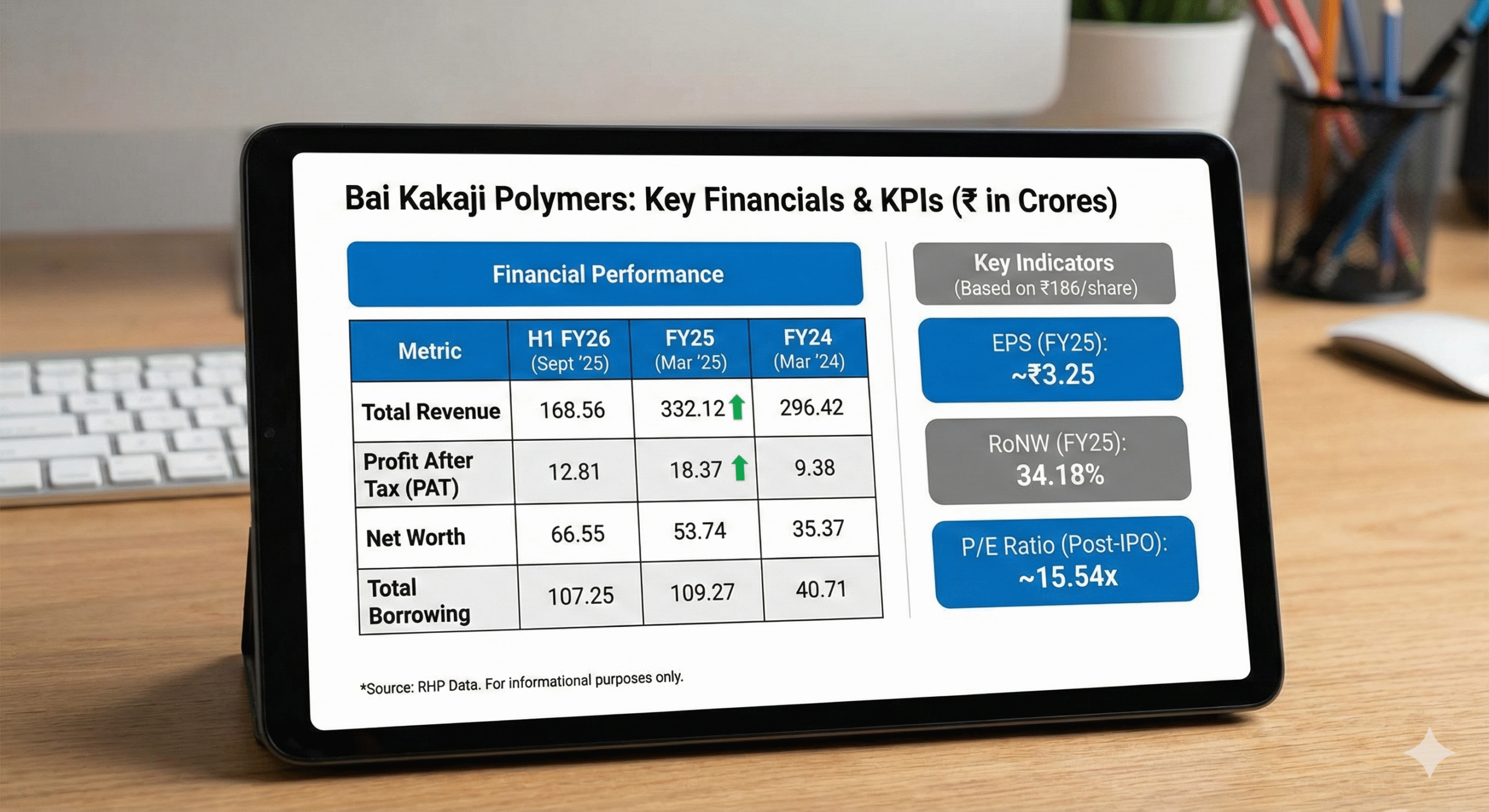

Financial Performance (₹ in Crores)

The company has shown growth in revenue and profit over the last few years.

| Particulars | As of Sept 30, 2025 (H1 FY26) | FY Ended March 31, 2025 | FY Ended March 31, 2024 |

| Total Revenue | ₹ 168.56 | ₹ 332.12 | ₹ 296.42 |

| Profit After Tax (PAT) | ₹ 12.81 | ₹ 18.37 | ₹ 9.38 |

| Net Worth | ₹ 66.55 | ₹ 53.74 | ₹ 35.37 |

| Total Borrowing | ₹ 107.25 | ₹ 109.27 | ₹ 40.71 |

Key Performance Indicators (KPIs) & Valuation

Based on the upper price band of ₹186 per share:

- Post-IPO P/E Ratio: Approximately 15.54x (based on FY25 earnings)

- Return on Net Worth (RoNW) – FY25: 34.18%

The company plans to use the IPO proceeds for debt repayment (₹60 Cr), setting up a solar power project, installing additional machinery, and general corporate purposes.

Disclaimer: This information is for educational purposes only and should not be considered financial advice. Investments in SME IPOs carry higher risk. Please consult with a qualified financial advisor before making any investment decisions.