The IPO is currently Open for subscription.1 It opened on Friday, December 26, 2025, and will close on Tuesday, December 30, 2025.

| Category | Details |

| Company Name | E to E Transportation Infrastructure Limited |

| IPO Type | SME IPO (Book Built Issue) |

| IPO Size | ₹84.22 Crores (Entirely a Fresh Issue of approx. 48.40 lakh shares) |

| Face Value | ₹10 per share |

| Price Band | ₹164 to ₹174 per share |

| Lot Size | 800 Shares |

| Minimum Investment | ₹1,39,200 (for Retail investors, at upper price band) |

| Listing At | NSE SME |

| Market Maker | Share India Securities Ltd. |

| Registrar | Link Intime India Pvt Ltd. |

| Book Running Lead Manager | Interactive Financial Services Ltd. |

Important Timelines (Tentative)

Due to the year-end, the listing will take place in the new year, 2026.

- IPO Open Date: Friday, December 26, 2025

- IPO Close Date: Tuesday, December 30, 2025

- Basis of Allotment: Wednesday, December 31, 2025

- Initiation of Refunds: Thursday, January 01, 2026

- Credit of Shares to Demat: Thursday, January 01, 2026

- Listing Date: Friday, January 02, 2026

Subscription Status (Day 1 Data – As of Dec 26, 2025)

On the first day of bidding (yesterday), the IPO saw moderate initial interest.

- Overall Subscription: approx. 1.15 times

- Qualified Institutional Buyers (QIB): Not yet subscribed

- Non-Institutional Investors (NII): Subscribed ~1.40 times

- Retail Individual Investors (RII): Subscribed ~1.95 times

About the Company

Incorporated in 2010, E to E Transportation Infrastructure is an integrated logistics services provider.2

- Core Business: Providing road transportation services for Full Truck Load (FTL) and Less than Truck Load (LTL) cargo.

- Specialization: They specialize in moving bulk goods, raw materials, and finished products across India.

- Fleet: The company operates a mix of owned vehicles and a network of attached fleet vehicles to manage pan-India operations.

- Clientele: They serve clients in sectors like FMCG, cement, steel, and infrastructure.

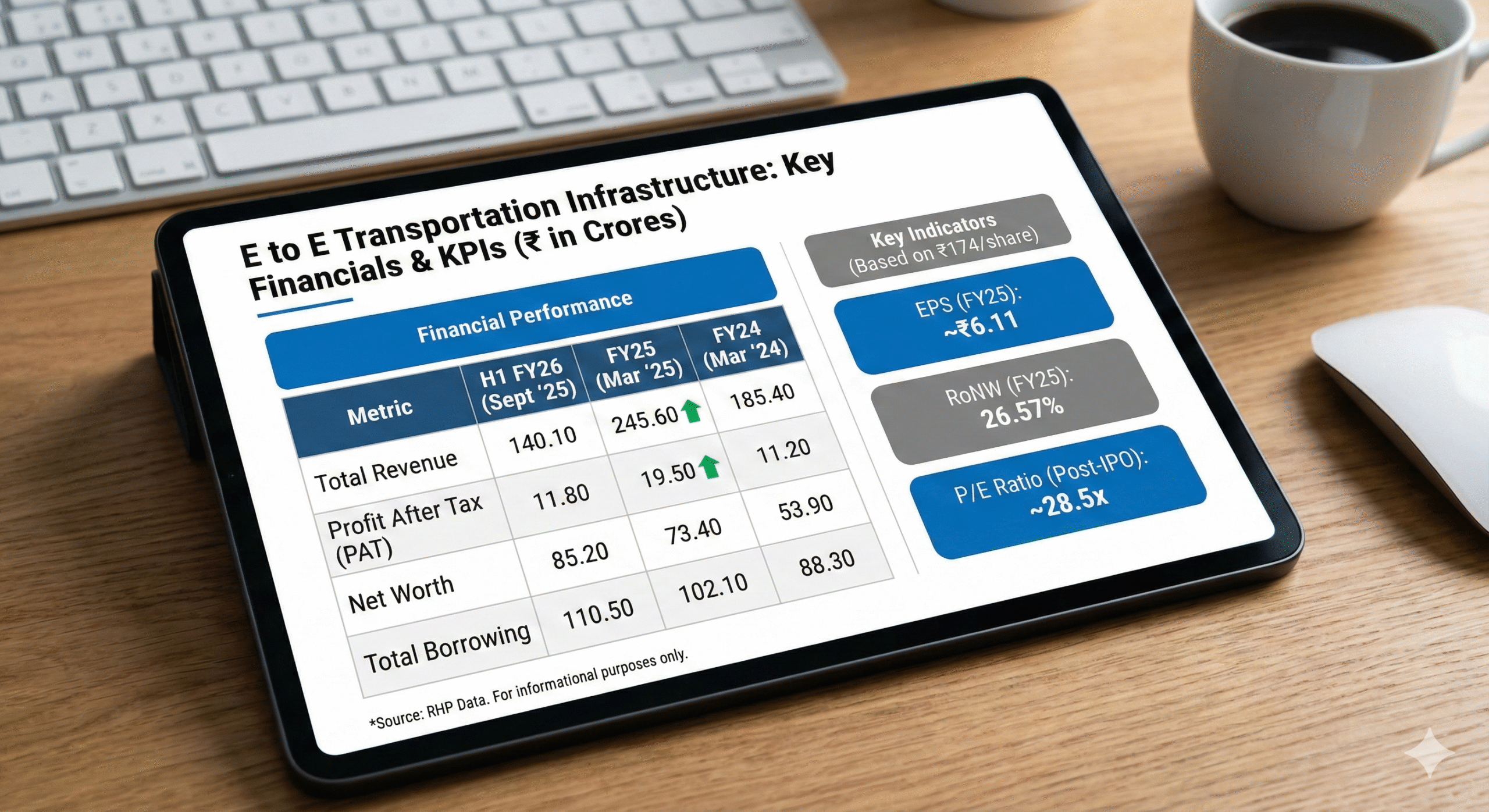

Financial Performance (₹ in Crores)

The company has shown consistent growth in topline and bottom line over the past few years, reflecting the growing demand in the logistics sector.

| Particulars | As of Sept 30, 2025 (H1 FY26) | FY Ended March 31, 2025 | FY Ended March 31, 2024 |

| Total Revenue | ₹ 140.10 | ₹ 245.60 | ₹ 185.40 |

| Profit After Tax (PAT) | ₹ 11.80 | ₹ 19.50 | ₹ 11.20 |

| Net Worth | ₹ 85.20 | ₹ 73.40 | ₹ 53.90 |

| Total Borrowing | ₹ 110.50 | ₹ 102.10 | ₹ 88.30 |

Key Performance Indicators (KPIs) & Valuation

Based on the upper price band of ₹174 per share and FY25 data:

- Post-IPO P/E Ratio: Approximately 28.5x

- Return on Net Worth (RoNW) – FY25: ~26.57%

The company intends to use the net proceeds from the issue for:

- Funding capital expenditure for the purchase of commercial vehicles.

- Meeting working capital requirements.

- General corporate purposes.

Disclaimer: This information is for educational purposes only and should not be considered financial advice. Investments in SME IPOs carry higher risk.3 Please consult with a qualified financial advisor before making any investment decisions. Subscription data is indicative.