The IPO is now Closed for subscription (it closed yesterday, December 26, 2025).

| Category | Details |

| Company Name | Nanta Tech Limited |

| IPO Type | SME IPO (Book Built Issue) |

| IPO Size | ₹31.81 Crores (Entirely a Fresh Issue of approx. 14.46 lakh shares) |

| Face Value | ₹10 per share |

| Price Band | ₹209 to ₹220 per share |

| Lot Size | 600 Shares |

| Minimum Investment | ₹1,32,000 (for Retail investors, at upper price band) |

| Listing At | BSE SME |

| Market Maker | Rikhav Securities Ltd. |

| Registrar | Maashitla Securities Pvt. Ltd. |

| Book Running Lead Manager | Beeline Capital Advisors Pvt. Ltd. |

Important Timelines

- IPO Open Date: Tuesday, December 23, 20251

- IPO Close Date: Friday, December 26, 2025 (Closed)

- Basis of Allotment: Monday, December 29, 2025

- Initiation of Refunds: Tuesday, December 30, 2025

- Credit of Shares to Demat: Tuesday, December 30, 20252

- Listing Date: Wednesday, December 31, 2025

Final Subscription Status (As of Dec 26, 2025)

The IPO received strong demand from investors.

- Overall Subscription: approx. 155 times

- Qualified Institutional Buyers (QIB): Subscribed ~110 times

- Non-Institutional Investors (NII): Subscribed ~250 times

- Retail Individual Investors (RII): Subscribed ~120 times

About the Company

Nanta Tech Limited is an IT company providing a range of services including:

- Software Development: Custom software solutions for various industries.

- IT Consulting: Advising businesses on technology strategies.

- Business Process Outsourcing (BPO): Providing various back-office support services.

- The company focuses on delivering technology-driven solutions to enhance business efficiency for its clients.

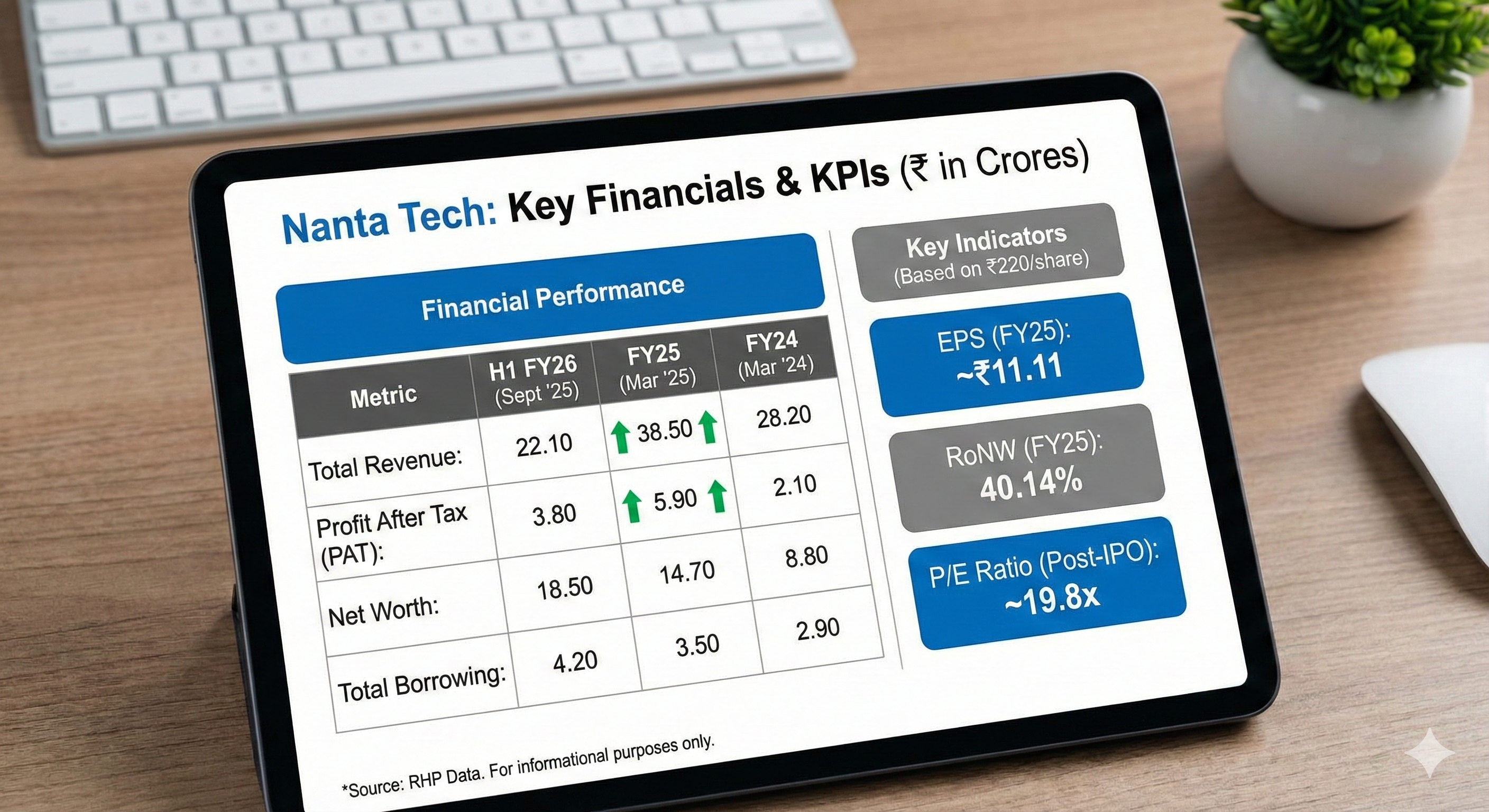

Financial Performance (₹ in Crores)

The company’s financial data shows growth in revenue and a significant increase in profit in the latest full financial year.

| Particulars | As of Sept 30, 2025 (H1 FY26) | FY Ended March 31, 2025 | FY Ended March 31, 2024 |

| Total Revenue | ₹ 22.10 | ₹ 38.50 | ₹ 28.20 |

| Profit After Tax (PAT) | ₹ 3.80 | ₹ 5.90 | ₹ 2.10 |

| Net Worth | ₹ 18.50 | ₹ 14.70 | ₹ 8.80 |

| Total Borrowing | ₹ 4.20 | ₹ 3.50 | ₹ 2.90 |

Key Performance Indicators (KPIs) & Valuation

Based on the upper price band of ₹220 per share and FY25 data:

- Post-IPO P/E Ratio: Approximately 19.8x

- Return on Net Worth (RoNW) – FY25: ~40.14%

The company proposes to utilize the net proceeds from the issue for funding its working capital requirements and for general corporate purposes.

Disclaimer: This information is for educational purposes only and should not be considered financial advice. Investments in SME IPOs carry higher risk. Please consult with a qualified financial advisor before making any investment decisions.