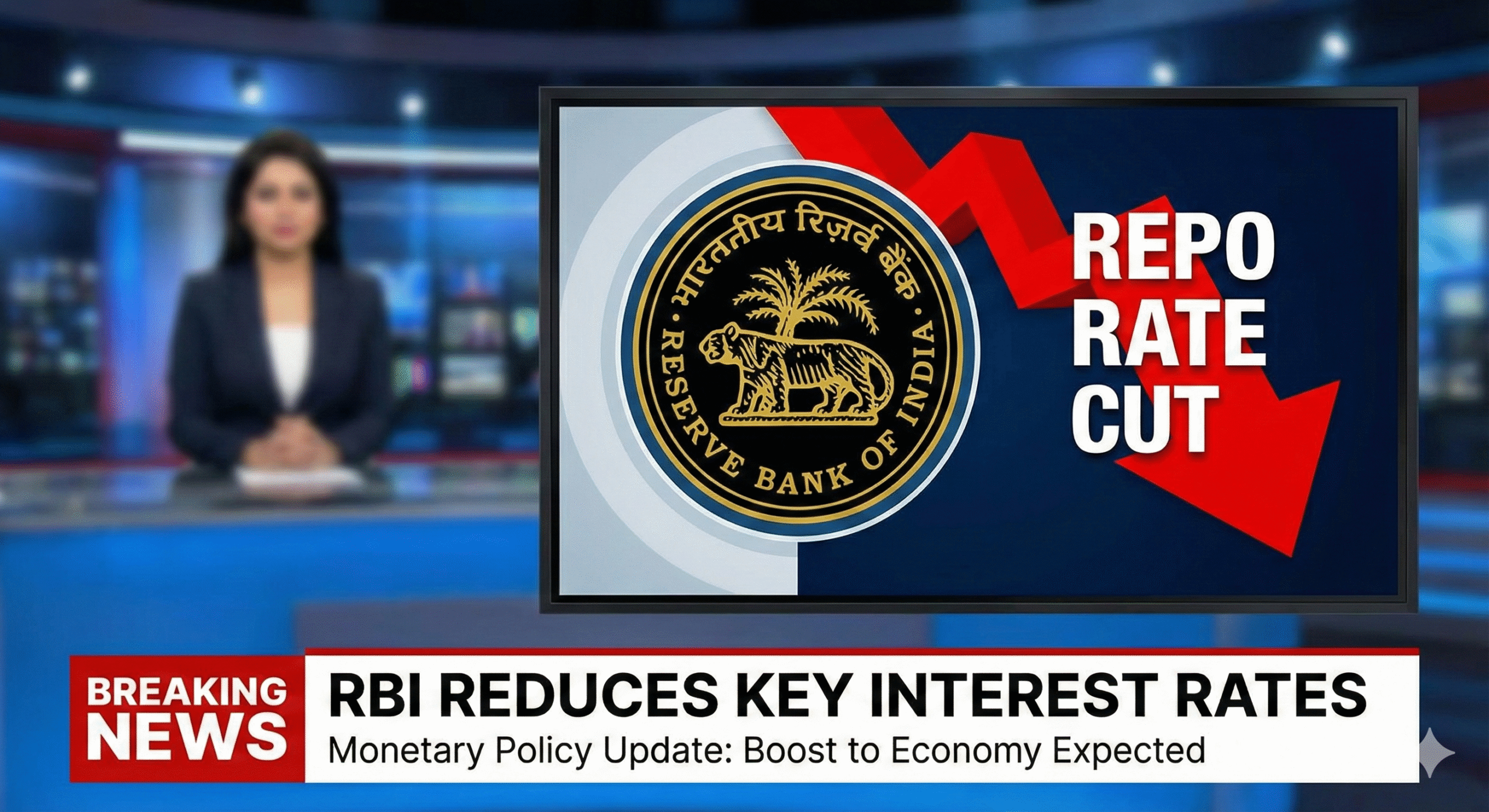

📉 Rate Cut Announced

The Reserve Bank of India lowered the repo rate by 25 basis points to 5.25%, aiming to support economic growth as inflation continues to cool.

🎯 Policy Stance

The RBI maintained a neutral stance, giving itself flexibility for future rate decisions.

💧 Liquidity Support

Additional steps, such as liquidity-boosting operations, were introduced to make borrowing easier throughout the system.

📊 Why this move?

- India’s economic growth remains solid, creating room to ease financial conditions.

- Inflation has softened, reducing the need for restrictive rates.

🏠 What changes for consumers?

- Loan EMIs may fall, especially for borrowers on floating rates — home and auto loans are likely to become cheaper.

- Banks may adjust lending and deposit rates — which can lower FD returns over time.